work opportunity tax credit questionnaire reddit

Work Opportunity Tax Credit Questionnaire Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a program created by the US. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group.

In Work Credits In The Uk And The Us Brewer 2019 Fiscal Studies Wiley Online Library

Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

. As of 2020 the tax credit can save employers up to 9600 per employee with no limit on the number of employees hired from targeted groups. The WOTC is available for wages paid to certain individuals who begin work on or before December 31 2025. With Efficient Hire it takes nearly zero effort.

About 10 minutes after I submitted my application the company sent me a Work Opportunity Tax Credit form to fill out and is asking for my SSN. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. Wotc is a federal tax credit designed to encourage businesses to hire individuals from certain targeted groups.

Employers may ask you certain WOTC screening questions to determine if they are eligible to apply for the tax credit. The Work Opportunity Tax Credit is a federal tax credit available to employers who hire and retain qualified veterans and other individuals from target groups that historically have faced barriers in securing employment. As part of the application process we ask that you complete a short questionnaire in order to assess eligibility for the Work Opportunity Tax Credit Program WOTC.

Thats a lot of money compared to the short amount of time it takes to screen new hires. 18 Jan 2022. The application asks for my Social Security Number but I feel uneasy providing it this early in the job application process considering that identity theft is on the rise.

Felons at risk youth seniors etc. Please contact the moderators of this subreddit if you have any questions or concerns. It also says that the employer is encouraged to hire individuals who are facing barriers to employment.

Completing Your WOTC Questionnaire. Its called WOTC work opportunity tax credits. A person becomes eligible when they meet the requirements of belonging to one of the target groups of people that includes Veterans people who have been.

Work opportunity tax credit questionnaire required. If you are in one of the target groups listed below an employer who hires you could receive a federal tax credit of up to 9600. Below you will find the steps to complete the WOTC both ways.

Qualified short-term and long-term IV-A recipients Temporary Assistance for Needy Families. It is voluntary on the new hires perspective an employer. FICO Credit Scores.

I am a bot and this action was performed automatically. By creating economic opportunities this program also helps lessen the burden on other government assistance programs. Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire that employers give to their new hires to determine if they are eligible for a tax credit for hiring that person.

This tax credit may give the employer the incentive to hire you for the job. I dont think there are any draw backs and Im pretty sure its 100 optional. Employers must apply for and receive a.

Make sure this is a legitimate company before just giving out your SSN though. At the low end of the scale a WOTC-certified new hire working at least 120 hours in the year could qualify you as the employer to claim 25 of the first years wages for a tax credit of as much as 1500. At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our website.

These are the target groups of job seekers who can qualify an. The Work Opportunity Tax Credit WOTC can help you get a job. Work opportunity tax credit questionnaire required.

WOTC is a federal tax credit program available to employers who hire and retain veterans and individuals from other target groups that may have challenges to securing employment. I just applied for a job with a well known beauty retailer about an hour ago. The Work Opportunity Tax Credit program is an incentive for employers to hire new employees from targeted groups of employees.

The following groups are considered target groups under the WOTC program. The first step to obtaining the Work Opportunity Tax Credit is figuring out if the worker you hired qualifies. I was under the impression that employers were not allowed to ask about age because it is a slippery slope to discriminating on the basis of age.

You and the applicant need to complete IRS Form 8850 which is the IRS pre-screening. This is a real thing meant to encourage businesses to hire people from groups that historically have trouble finding employment. That is why before the employee begins to work for your business you need to have them fill out two forms and follow these steps.

The WOTC Questionnaire asks questions that are not visible to the hiring managers or hr except admins that control the data flow. A company hiring these seasonal workers receives a tax credit of 1200 per worker. New hires may be asked to complete the wotc questionnaire as part of their onboarding paperwork or even as part of.

Improving Credit Scores and Building Credit. New hires may be asked to complete the WOTC questionnaire as part of their onboarding paperwork or even as part of the employment application in some cases. In the case of the above question the sender did not provide their email address so we were unable to reply directly to them.

Some companies get tax credits for hiring people that others wouldnt. Ive been searching for employment for some time and have came across companies asking me to fill out a tax screening form because the employer participates in the work opportunity tax program. Im trying to apply for a part-time retail job over the summer.

Ive never been asked to fill out a. The data is only used if you are hired. The Work Opportunity Tax Credit or WOTC is a general business credit provided under section 51 of the Internal Revenue Code Code that is jointly administered by the Internal Revenue Service IRS and the Department of Labor DOL.

This tax credit is for a period of six months but it can be for up to 40. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. It asks for your SSN and if you are under 40.

It is legal and you can google it. Companies hiring long-term unemployed workers receive a tax credit of 35 percent of the first 6000 per new hire employee earned in monthly wages during the first year of employment.

Mass Production Of Professional Services And Pseudo Professional Identity In Tax Preparation Work Academy Of Management Discoveries

In Work Credits In The Uk And The Us Brewer 2019 Fiscal Studies Wiley Online Library

Taxing Subjects The Blog For Tax Pros Covering Tax Irs News And More

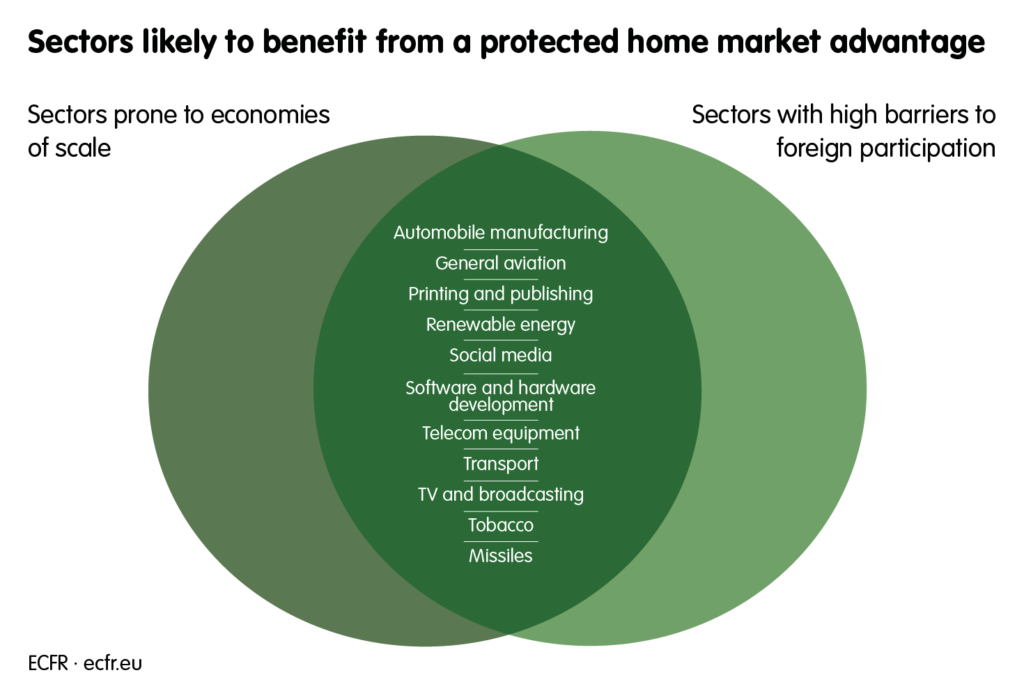

Home Advantage How China S Protected Market Threatens Europe S Economic Power European Council On Foreign Relations

Present Bias And Externalities Can Government Intervention Raise Welfare Kotsogiannis Canadian Journal Of Economics Revue Canadienne D 233 Conomique Wiley Online Library

In Work Credits In The Uk And The Us Brewer 2019 Fiscal Studies Wiley Online Library

In Work Credits In The Uk And The Us Brewer 2019 Fiscal Studies Wiley Online Library

Digitizing Taxation And Premature Formalization In Developing Countries Roy 2021 Development And Change Wiley Online Library

Digitizing Taxation And Premature Formalization In Developing Countries Roy 2021 Development And Change Wiley Online Library

In Work Credits In The Uk And The Us Brewer 2019 Fiscal Studies Wiley Online Library

Wotc Questions Can Family Members Qualify Employers For The Wotc Tax Credit Cost Management Services Work Opportunity Tax Credits Experts

In Work Credits In The Uk And The Us Brewer 2019 Fiscal Studies Wiley Online Library

Home Advantage How China S Protected Market Threatens Europe S Economic Power European Council On Foreign Relations

In Work Credits In The Uk And The Us Brewer 2019 Fiscal Studies Wiley Online Library